Payment and filing for the PF return date are probably the same and you can process it at the same time. Ad Submit Your Eastern Fuel Payment Online with doxo.

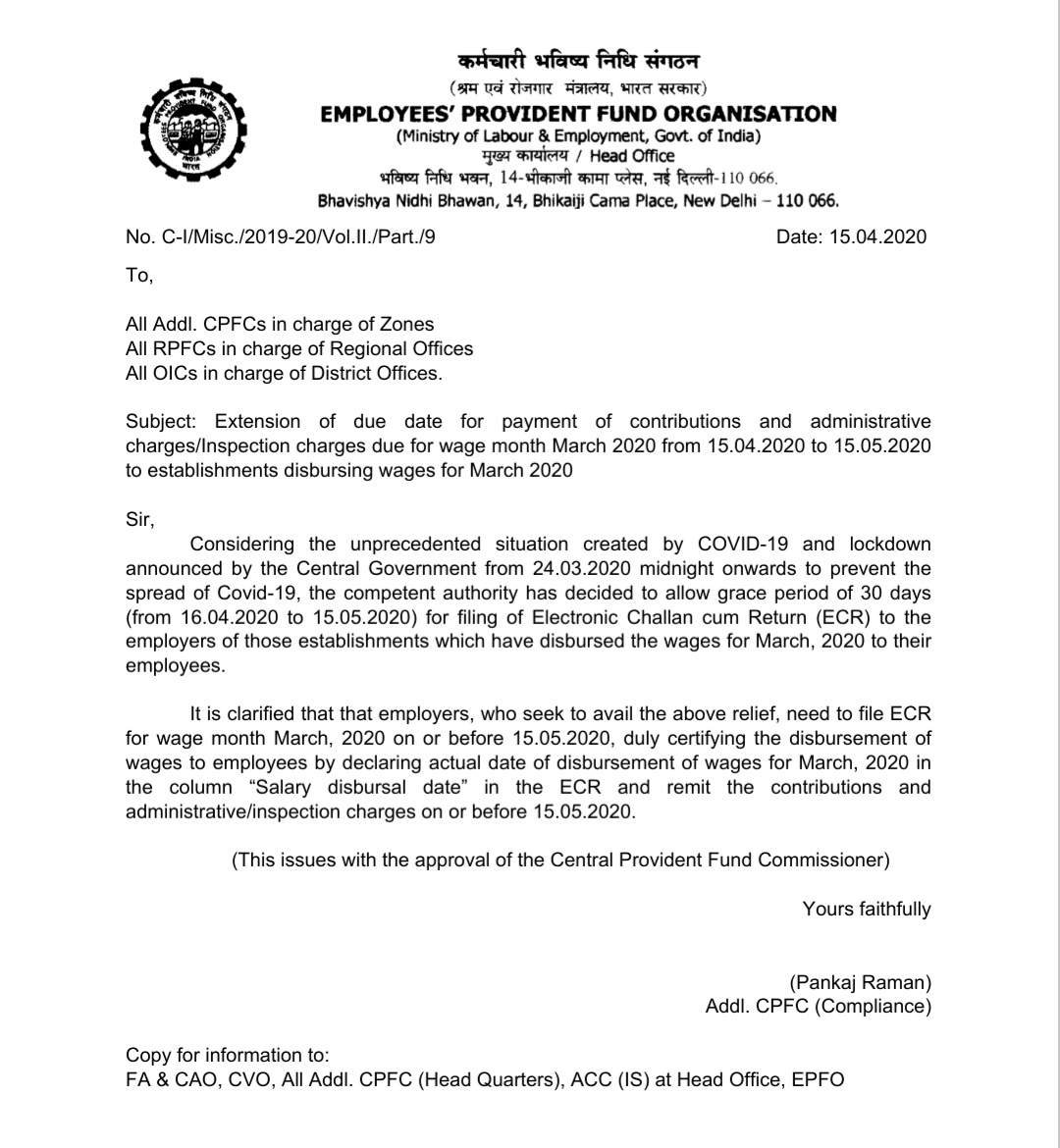

Relief To Establishments From Levy Of Penal Damages For Delay In Deposit Of Epf During Lockdown

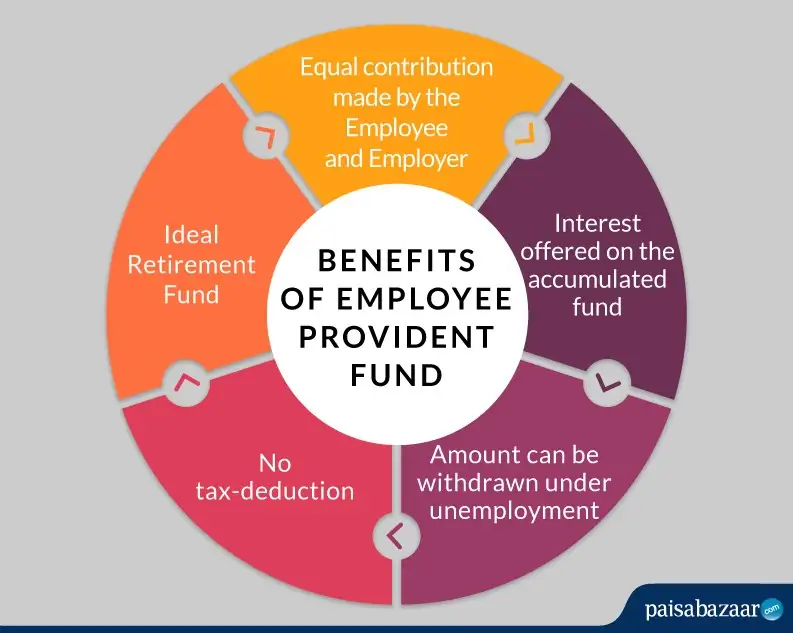

8 of the total monthly earnings To be deducted from the employees salarywage.

. Go to the Manage option in. The due date for EPF payment is the date on which employers deduct and make payment of the PF amount. To ensure you submit your statutory files on time do take note of the following deadlines to ensure your company will not need to pay fines.

An amount equivalent to 12 of total monthly income. Arrangements to Provide Services of Employees Provident Fund Department of the Central Bank of Sri Lanka Remotely Regionally due to Travel Restrictions in the Country. Therefore the due date of the PF return is the same as the payment date and that.

PF due date is the last date to pay the periodic installment towards PF by the employer by a total of 12 of employee wage. Penalty charge for late payment under Section 14B - In case of delay or failure of challan payment the following penalties are charged -. The employers disbursing the wages for.

The due date for payment of Provident Fund PF contributions PF Contribution amount is a sum of the employees contribution to Provident Fund deducted from the employees salary and the. - Extension of due date for payment of contributions and administrative chargesInspection charges due for wage month march 2020 from 15042020 to 15052020 to establishments. Here are the steps to link EPF account with Aadhaar online.

5 interest per year for delays of up to. EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. This is in line with the original contribution payment date.

The deduction from an employees salary is done on or before the. The ECR with the said declaration and contributions and administrative charges for March 2020 are now due on or before 15052020. The date for employers to remit their mandatory contribution for 2021 is now the 15th of every month starting January 2021.

The employers disbursing the wages for March 2020 not only get relief of extension of due date for payment of EPF dues for March 2020 but also avoid liability of. Contribution Payment deadline. If contributions are made later than the 15th of following month if the 15th is a holiday the deadline will be the last working day before the 15th a fine of 6 per annum for each day.

The central government has decided that 15th. Visit the EPFOs member portal and login through username and password.

Epf Payment Due Date For March 2020 Is Extended To 15 May 2020

Provident Fund Pf Due Date Payment Return Filing Indiafilings

Epfo Date Of Filing Electronic Challan Cum Return Ecr Facebook

How To Report Epf And Esi Due Date Extension In Tax Audit Report For Ay 2020 21

Epfo Subscribers Get More Time To Complete E Nomination Process Details Here

How To Update Epf Date Of Exit Online Without Employer Basunivesh

E P F Organisation Epfo Lucknow Facebook

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Govt May Soon Allow Firms To Delay Epf Contributions Or Pay In Installments Business Standard News

Epf Payment Online Procedure Receipt Download Late Payment Penalty

Govt Extends Due Date To File Pf Contribution Returns For The Month Of March 2020

Epf Interest Rate 2022 23 Notification Calculate Latest News

New Epf Rules 2021 Latest Amendments To Epf Act

Epf Contribution Reduced From 12 To 10 For Three Months

Pf Payment Due Date For April 2020 Youtube

Pf Payment Due Dates For Fy 2019 20 For Tax Audit Reporting

Due Dates Relating To Payroll India Esi Pt Pf Tds

How To Update Epf Date Of Exit Online Without Employer Basunivesh

Payroll Related Filling Extended Deadlines Due To Mco Yau Co